Some Ideas on Pvm Accounting You Need To Know

Some Ideas on Pvm Accounting You Need To Know

Blog Article

The Best Guide To Pvm Accounting

Table of ContentsWhat Does Pvm Accounting Mean?Some Known Facts About Pvm Accounting.Pvm Accounting Things To Know Before You BuyThe 2-Minute Rule for Pvm AccountingThe 7-Minute Rule for Pvm Accounting5 Simple Techniques For Pvm AccountingThe Buzz on Pvm Accounting

In terms of a business's overall strategy, the CFO is liable for leading the firm to fulfill economic goals. Some of these methods could involve the firm being acquired or acquisitions going ahead.

As a service expands, bookkeepers can free up extra team for other organization tasks. As a building firm grows, it will require the help of a full time economic team that's managed by a controller or a CFO to manage the company's finances.

The 5-Second Trick For Pvm Accounting

While huge businesses might have permanent economic assistance teams, small-to-mid-sized services can employ part-time bookkeepers, accounting professionals, or economic advisors as required. Was this short article helpful?

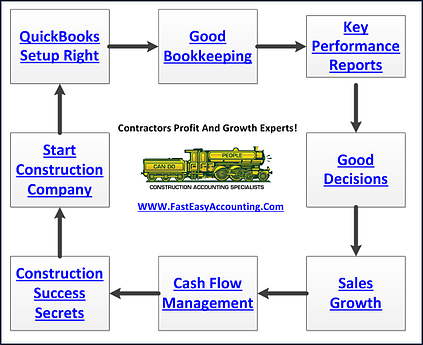

Reliable audit techniques can make a significant difference in the success and development of building business. By carrying out these methods, building companies can enhance their financial stability, simplify procedures, and make informed choices.

Detailed quotes and spending plans are the foundation of building job monitoring. They assist steer the job towards prompt and profitable completion while securing the rate of interests of all stakeholders involved. The key inputs for task price evaluation and spending plan are labor, materials, equipment, and overhead expenses. This is generally among the biggest costs in building and construction projects.

The Single Strategy To Use For Pvm Accounting

An accurate estimation of materials required for a task will assist make certain the necessary products are acquired in a timely way and in the best quantity. An error here can lead to waste or delays due to material scarcity. For most building projects, equipment is needed, whether it is bought or leased.

Do not forget to account for overhead expenses when approximating task costs. Straight overhead expenses are specific to a task and might consist of short-term rentals, utilities, fence, and water supplies.

Another variable that plays into whether a task succeeds is an exact estimate of when the task will be completed and the related timeline. This estimate assists guarantee that a job can be ended up within the assigned time and sources. Without it, a project may lack funds prior to completion, triggering potential work deductions or desertion.

The 10-Minute Rule for Pvm Accounting

Exact job costing can help you do the following: Recognize the success (or lack thereof) of each project. As work setting you back breaks down each input into a task, you can track earnings individually. Contrast actual expenses to price quotes. Taking care of and analyzing quotes enables you to better rate jobs in the future.

By determining these things while the job is being finished, you avoid surprises at the end of the project and can resolve (and with any luck avoid) them in future projects. A WIP routine can be finished monthly, quarterly, semi-annually, or each year, and consists of job information such as contract value, costs sustained to date, total approximated prices, and total project billings.

Unknown Facts About Pvm Accounting

Budgeting and Projecting Devices Advanced software program provides budgeting and forecasting capacities, enabling building business to prepare future projects much more precisely and handle their funds proactively. File Monitoring Construction tasks involve a whole lot of documents.

Improved Supplier and Subcontractor Administration The software can track and manage settlements to suppliers and subcontractors, ensuring prompt payments and maintaining excellent partnerships. Tax Prep Work and Declaring Bookkeeping software can aid in tax preparation and declaring, making certain that all relevant financial activities are accurately reported and tax obligations are submitted on schedule.

The Only Guide to Pvm Accounting

Our client is a growing development and construction firm with headquarters in Denver, Colorado. With multiple energetic building tasks in Colorado, we are trying to find an Audit Assistant to join our team. We are seeking a permanent Accountancy Assistant who will certainly be accountable for providing useful assistance to the Controller.

Obtain and examine everyday billings, subcontracts, adjustment orders, acquisition orders, inspect requests, and/or various other associated paperwork for completeness and conformity with financial policies, procedures, spending plan, and legal demands. Exact handling of accounts payable. Go into billings, approved draws, order, etc. Update monthly analysis and prepares budget plan pattern reports for building and construction projects.

Getting The Pvm Accounting To Work

In this overview, we'll explore various elements of building bookkeeping, its importance, the standard devices used around, and its role in building and construction tasks - https://trello.com/w/pvmaccount1ng. From financial control and price estimating to capital management, explore exactly how accountancy can benefit building and construction tasks of all ranges. Building and construction audit refers to the specific system and procedures made use of to track monetary details and make strategic choices for building companies

Report this page